Developing an Efficient Expense Reimbursement Policy

by Paul Devlin

Expense reimbursement is a critical aspect of financial management within any company, ensuring that employees are compensated for out-of-pocket expenses incurred on behalf of the business. However, developing an efficient expense reimbursement policy and integrating it with your company’s payroll system can be a complex process. This guide will walk you through the steps to create a user-friendly policy that controls costs while addressing the concerns of both employees and executives.

Step 1: Define Eligible Expenses

Criteria for Eligibility

- Define what constitutes an eligible expense with clarity. Typically, these are costs directly related to the performance of job duties, including travel, lodging, meals, and office supplies.

- Set clear boundaries for what is not reimbursable, such as personal entertainment or fines for traffic violations.

Step 2: Establish Reimbursement Limits and Approvals

Setting Limits

- Implement daily or per-item spending limits to encourage responsible spending.

- Consider using a tiered system based on job roles or departments for greater flexibility.

Approval Process

- Design an approval workflow that includes immediate supervisors and the finance department.

- Utilize digital approval tools to streamline the process and maintain records.

Step 3: Documentation and Submission Guidelines

Required Documentation

- Insist on original receipts or digital proofs for all claims.

- Establish a timeframe for submission post-expense to ensure timely processing.

Submission Process

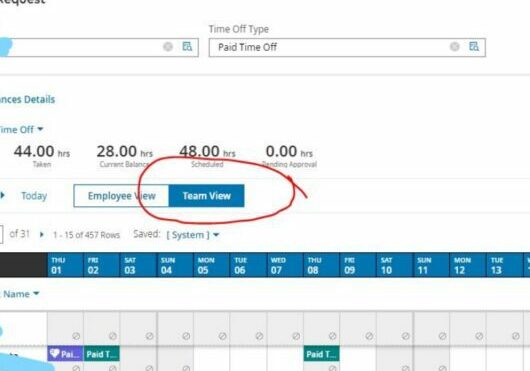

- Use a standardized form or digital platform for submitting reimbursement requests.

- Clearly outline the process for submission and review, including any required itemization or explanation of expenses.

- Encourage employees to submit requests in a timely manner to avoid delays.

Step 4: Reimbursement and Tracking

Timely Reimbursements

- Set clear guidelines for the timeline of reimbursements, such as within two weeks of approval.

- Utilize direct deposit or electronic transfer options for faster reimbursement.

Tracking Expenses

- Implement a system for tracking expenses and reimbursements, such as an online portal or spreadsheet.

- Make sure all records are organized and easily accessible for audits or reporting purposes.

- Regularly review expense reports to identify any discrepancies or areas for improvement.

- Encourage open communication between employees and the finance department regarding any concerns or questions about reimbursements.

By following these steps, you can create an efficient and effective employee reimbursement process that benefits both the company and your employees.

This article does not constitute legal advice. For more information please reference related expense reimbursement articles in your APlus HR resource center or ask your friendly APlus CSS about options to track employee expenses within our software.