Five Ways to Manage Gratuities

by Paul Devlin

Managing gratuities effectively is crucial for businesses, especially in the hospitality and service industries, where tipping significantly impacts employee income and customer experience. A comprehensive strategy for handling gratuities involves understanding legal requirements, impact on customer satisfaction, and internal fairness among employees. Here’s a detailed approach to developing such a strategy:

1. Understand Legal Requirements:

- Compliance with Local Laws: Different jurisdictions have varying laws regarding tipping. It’s essential to understand whether tips can be considered part of minimum wage, if there are requirements for tip pooling, and how taxes are handled. Consulting with a legal expert in this area is advisable.

- Fair Labor Standards Act (FLSA) Compliance: Ensure compliance with the FLSA which governs how tipped employees are paid.

2. Impact on Customer Satisfaction:

- Transparency: Clearly communicate tipping policies to customers, whether tips are included in the pricing, expected but not included, or not expected at all.

- Service Quality: Emphasize that while tipping is appreciated, the quality of service should not depend on the anticipation of a tip.

3. Best Practices for Communicating Tipping Policies to Customers:

- Visibility: Use signage, menu notes, or digital platforms to inform customers about your tipping policy in a clear and concise manner.

- Training Staff: Ensure staff can articulate the tipping policy politely and accurately if asked by customers.

4. Handling Disputes or Discrepancies Related to Tip Allocation:

- Clear Tip Pooling Policy: Develop a transparent and fair tip pooling policy, understood and agreed upon by all employees. This policy should detail how tips are collected, distributed, and what happens in the case of discrepancies.

- Dispute Resolution Process: Establish a clear process for resolving disputes over tips, including a point person for grievances and a method for investigation and resolution.

5. Proper Distribution and Tracking of Gratuities:

- Fair Distribution System: Implement a system that fairly distributes tips among eligible staff. This could be based on hours worked, job role, or a combination of factors.

- Record-Keeping: Maintain accurate records of all tips received and distributed. This is crucial for tax purposes and resolving any disputes that may arise.

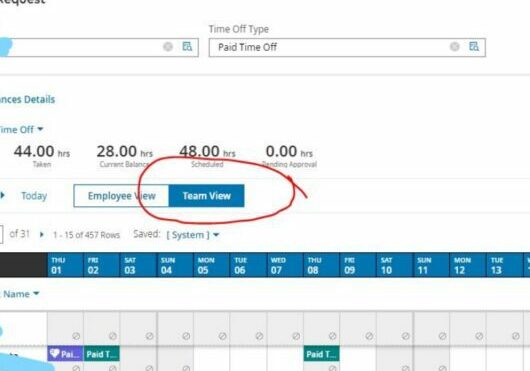

- Technology Solutions: Consider using software designed for tip management, which can automate the distribution process and ensure transparency and accuracy.

By addressing these areas comprehensively, businesses can develop a robust strategy for managing gratuities that aligns with legal requirements and ensures fair treatment of employees. Transparency, fairness, and clear communication are key principles that should guide any tipping policy.

This article does not constitute legal advice. For more information please reference related articles in your APlus HR resource center or ask your friendly APlus CSS about our time and tip tracking options to improve your efficiencies.