The Importance of Payroll Management for Business Productivity: An Overlooked Game-Changer

by Paul Devlin

When it comes to running a successful business, several key elements often steal the limelight—innovative ideas, strategic planning, marketing prowess, and customer service. While these are undoubtedly vital, one critical aspect that’s frequently overlooked is payroll management. However, when executed properly, effective payroll management can significantly advance the company’s overall performance.

What is Payroll Management?

In its simplest form, payroll management involves the administration of employees’ financial records—salaries, wages, bonuses, deductions, and net pay. It may seem like a mundane administrative task, but in reality, it’s much more than just ensuring everyone gets paid on time. It’s about reducing errors, increasing employee satisfaction, and improving record keeping, all of which contribute to a company’s productivity.

The Benefits of Proper Payroll Management

Reducing Errors

A minor error in payroll processing can result in significant financial loss over time. For example, an organization with 100 employees, if incorrectly paying an extra $10 per month, could lose $12,000 annually due to this seemingly small oversight. Effective payroll management helps to mitigate such errors, saving the company money in the long run.

Increasing Employee Satisfaction and Motivation

Employees are the backbone of any organization. When they receive their salaries accurately and on time, it boosts their morale, leading to increased productivity. A study by the American Payroll Association found that problems with payroll can cause up to 49% of workers to start job hunting. Hence, getting payroll right is crucial to retaining talented individuals.

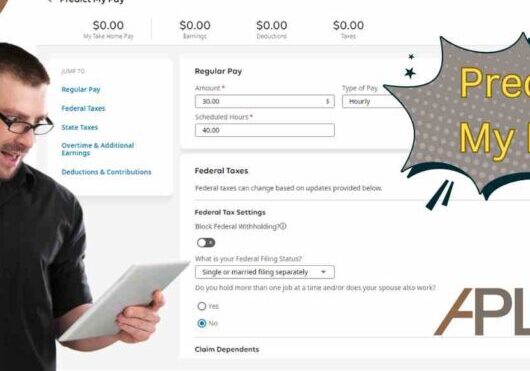

Additionally, a payroll system should allow for smooth communication between employers and employees. It should be able to provide the staff with effective visibility into their earnings and deductions, as well as other details such as vacation/sick days or tax withdrawals. As a result, employees can rest assured that they are being paid correctly while still having access to all of the necessary information, whether in person, on their desktop, or even an app. This reduces the need for manual processes, which can be time-consuming and prone to errors.

Improving Record Keeping

Payroll records are not just about numbers. They provide a wealth of information that can be used for strategic decision-making. They help track labor costs, identify trends, and even assist in budget forecasting. In addition, maintaining accurate payroll records is essential for compliance with tax and labor laws.

Tips for Improving Payroll Management

Proper payroll management doesn’t happen by accident—it requires a proactive approach. Here are some tips to get you started:

-

Invest in Payroll Software or better still, use a Payroll provider: Modern payroll software can automate most of the payroll tasks, reducing the likelihood of errors and saving time. Using a payroll provider takes it one step further and provides access to professionals experienced in payroll operations, as well as never having to worry about updating your software to the latest version.

-

Stay Updated with Laws: Tax and labor laws change frequently. Staying updated with these changes can prevent costly penalties.(If you are using a Payroll provider this is done for you)

-

Provide Training: Make sure that those handling payroll are properly trained and understand the importance of their role. (Your Payroll provider can help with this)

-

Regular Audits: Regularly auditing your payroll process can help identify any discrepancies and areas of improvement. (Again, a Payroll provider can assist)

To sum up, payroll management may not be the most glamorous aspect of running a business, but its impact on the company’s productivity is undeniable. By giving it the attention it deserves, businesses can not only avoid costly mistakes but also unlock potential benefits that contribute significantly to their success.