The Pros and Cons of Paper Checks vs Electronic Payroll

by Paul Devlin

The move from paper checks to an electronic payroll system is a significant step towards modernizing your business operations. This transition not only streamlines the payroll process but also brings with it several benefits and challenges. Let’s dive in to the pros and cons of both.

Paper Checks vs. Electronic Payroll

Pros of Paper Checks:

- Familiarity: Both employers and employees are often used to the traditional method of paper checks.

- No Need for Bank Accounts: Employees don’t need a bank account to receive their payment.

Cons of Paper Checks:

- Costly: Issuing paper checks can be expensive due to printing and delivery costs.

- Time-Consuming: Manual preparation, printing, and distribution take significant time.

- Security Risks: Paper checks are susceptible to loss, theft, or fraud.

Pros of Electronic Payroll:

- Increased Security: Less risk of theft or loss and enhanced data protection.

- Cost Savings: Reduces the costs associated with paper, printing, and delivery.

- Convenience: Streamlines the payroll process, making it faster and more efficient.

- Environmental Friendliness: Less paper waste.

Cons of Electronic Payroll:

- Cybersecurity Requirements: Requires robust cybersecurity measures to protect sensitive information.

- Initial Setup and Training: Initial setup, software purchase, and employee training can be time-consuming and costly.

Benefits of Electronic Payroll

The transition to electronic payroll offers several notable benefits:

- Enhanced Security: Digital payments minimize the risk of check fraud and lost or stolen checks.

- Lower Operational Costs: Eliminating the need for paper saves money on supplies and processing.

- Increased Efficiency: Automates many payroll processes, saving time and reducing errors.

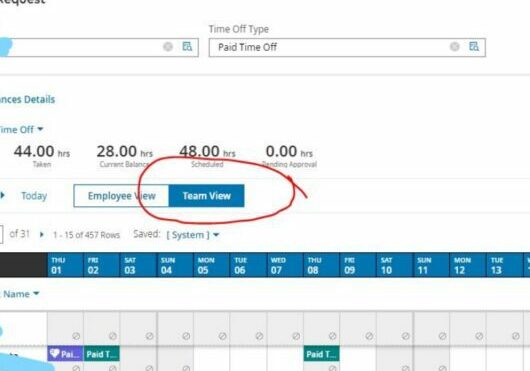

- Instant Access: Employees have immediate access to their funds and digital paystubs.

Potential Drawbacks

While the benefits are substantial, some challenges include:

- Cybersecurity Threats: The risk of data breaches necessitates strong security protocols.

- Employee Resistance: Some employees may prefer traditional checks or lack trust in digital systems.

Technical Considerations

Selecting a Payroll Provider

Research and select a reputable payroll provider that offers electronic payroll services aligned with your business needs. Research online reviews and also consider how customizable the software is.

Upgrading Software and Hardware

Ensure your systems meet the technical requirements for running the electronic payroll software effectively. This might include upgrades to your current IT infrastructure.

Employee Training and Support

Plan for comprehensive training for employees on how to use the new system and access their pay information online. Set up support channels to address any issues or concerns.

Key Steps for a Smooth Transition

-

Communicate the Change: Start by informing your employees about the transition, highlighting the benefits and addressing any concerns.

-

Select the Right Provider: Choose a payroll provider that fits your business needs and budget. Look for features like ease of use, customer support, and compliance with regulations.

-

Prepare Your Data: Ensure all employee information is accurate and up-to-date. This includes legal names, addresses, social security numbers, and bank account details for direct deposits.

-

Test the New System: Before going live, run several tests to ensure the system works as expected. Include a variety of scenarios to cover all payroll eventualities.

-

Train Your Employees: Provide training sessions for your employees, teaching them how to access their pay stubs, set up direct deposit, and whom to contact for support.

Transitioning to electronic payroll is a strategic move that can significantly benefit your business and employees. By carefully planning the transition, communicating effectively with your staff, and providing the necessary training and support, you can ensure a smooth shift to a more efficient, secure, and cost-effective payroll system.

For more information about how APlus can help streamline your payroll process and help set up electronic payment for your employees, contact us directly. Thank you for thinking of us, where we make payroll simple and convenient.