The Ultimate Payroll Checklist for Small Business Owners

by Paul Devlin

As a small business owner, setting up a payroll system might not be the most exciting part of your entrepreneurial journey, but it’s undeniably one of the most critical. Payroll is not just about ensuring your team gets paid on time; it’s a direct reflection of your business’s operational integrity and compliance with various legal requirements. Let’s dive into creating a comprehensive payroll checklist that will help streamline this essential business function.

Why Is Setting Up Payroll Necessary?

Regardless of size, every business with employees needs a reliable payroll system. It’s not merely a mechanism for compensating your team but also a way to withhold the correct taxes, contribute to social security, and ensure compliance with labor laws. Mismanaging payroll can lead to unhappy employees, legal penalties, and significant damage to your business reputation.

Your Payroll Checklist

Here’s a step-by-step checklist to ensure you cover all bases when setting up your payroll:

1. Obtain an Employer Identification Number (EIN)

Before anything else, you’ll need an EIN from the IRS. Think of it as your business’s social security number, essential for reporting taxes and other documents to the IRS and state agencies.

2. Classify Your Employees Correctly

Misclassification of employees as independent contractors or vice versa can lead to severe penalties. Understand the legal definitions and classify each member of your team correctly to ensure compliance with wage and hour laws.

3. Determine Your Payroll Schedule

Deciding how often to run payroll is crucial. Whether it’s weekly, bi-weekly, or monthly, your payroll schedule should comply with state laws and suit your business operations.

4. Set Up Employee Files

Maintain accurate and comprehensive files for each employee, including their W-4 forms, pay rate, and hours worked. This step is vital for accurate payroll processing and record-keeping.

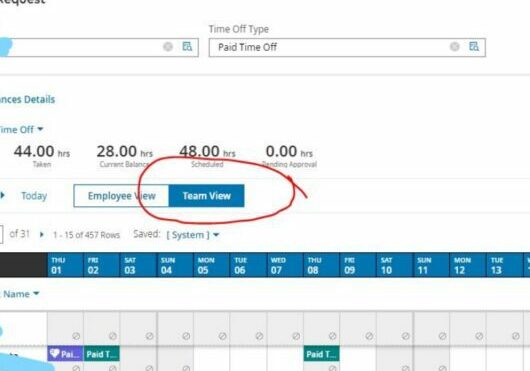

5. Select a Payroll System or Provider

Choose between manual payroll processing, using software, or outsourcing to a payroll provider like APlus. Each option has its pros and cons, depending on your business size, complexity, and budget.

Common Payroll Issues and How to Avoid Them

- Delayed Payroll: Always adhere to your payroll schedule. Delays can demotivate employees and lead to legal complications.

- Inaccurate Tax Withholdings: Use updated tax tables or software to calculate the correct withholdings and avoid penalties.

- Poor Record Keeping: Keep detailed records of all payroll activities for at least three years to comply with IRS requirements.

Consequences of Neglecting Payroll

Failing to establish a proper payroll system can result in unhappy employees, tax penalties, and even legal action against your business. It’s a critical component that requires attention to detail and ongoing management. By following the steps outlined in this checklist, you can ensure a smooth payroll process that complies with legal requirements and supports your team’s financial well-being.

Why APlus?

When selecting the optimal payroll solution, consider factors like cost, scalability, service level and ease of use. Think also about the specific features your business needs, such as tax filing support, direct deposit options, and integrations with existing systems. Similar to insurance providers, if you have an emergency, consider how easy is it to get hold of a real person in your time of need? If you have further questions or need more detailed advice on how we can customize a solution for you, feel free to get in touch. If you’re not a fit for us, we’ll happily suggest a solution that might be. Remember, investing time and resources into establishing a robust payroll system and support now can save you from headaches and penalties down the line.