Why Pay Frequency Matters For You And Your Employees

by Paul Devlin

When it comes to attracting and retaining top talent, an organization’s approach to remuneration can make or break the game. Beyond the basic salary amount, the pay frequency—or how often employees receive a paycheck—plays a pivotal role in the employer-employee relationship and can have significant implications on your business’s operations, culture, and bottom line. Let’s unravel the intricacies of pay frequencies and why they’re more than just a logistical payroll decision.

The Basics of Pay Frequency

Before you can understand its significance, you must comprehend what pay frequency actually is. Pay frequency refers to the schedule on which employees are paid their wages. This can range from weekly to monthly payments, and each frequency carries its own set of benefits and challenges.

Pay Frequency Types

Typically an employer has four options when it comes to pay frequency: weekly, biweekly, semi-monthly and monthly. (Tip: “bi” means two whereas “semi” means half.) Here are the pros and cons of each to help you determine the right pace for your payroll.

Weekly

|

Bi-weekly

|

Semi-monthly

|

Monthly

|

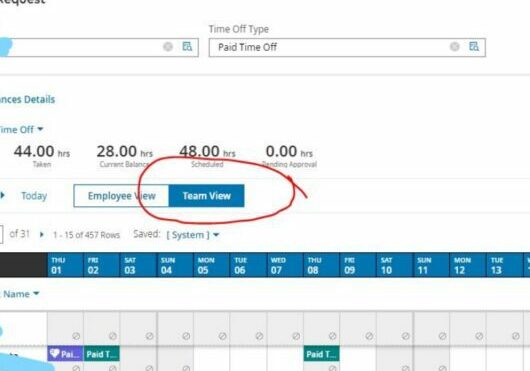

The Impact of Pay Frequency on Employee Finances

Pay frequency has a direct impact on how employees manage their finances, monthly budgets, and overall financial stability. It’s not just a matter of when the money lands in an employee’s bank account; it’s about how that money is spread across their obligations, savings, and disposable income.

-

The Budgeting Dilemma

Frequent paychecks can help employees align their finances with their day-to-day expenses. Conversely, less-frequent payments demand more strategic financial planning, and for some, can result in greater difficulty in managing debt, paying bills, and coping with unexpected expenses.

-

Financial Well-Being

Stress often accompanies financial instability, and the regularity of pay can either alleviate or exacerbate this stress. A well-structured pay frequency can contribute to employees’ overall financial well-being, reducing stress and creating a more content and focused workforce.

Operational Considerations and Compliance

Choosing a pay frequency isn’t just about employees; it also impacts your company’s operations, process complexity, and regulatory compliance.

-

Payroll Processing Efficiency

Efficiency is key, and your chosen pay frequency must align with the resource capabilities of your payroll department. A frequency that’s too demanding could lead to errors, significant workload pressure, and a depletion of valuable company resources.

-

Legal Framework

Employers must also ensure that their chosen pay frequency adheres to State and federal labor laws. Regulatory compliance is non-negotiable and can be complex when multiple legislation layers come into play. Here’s a good resource to check on what is required within each State

The Employee Experience: Retention, Recruitment, and Motivation

A thoughtful approach to pay frequency can significantly enhance the employee experience, influencing retention rates, recruitment efforts, and motivation levels.

-

Attracting Talent

In a job market where top talent is in high demand, offering a pay frequency that complements employees’ financial needs can be a compelling differentiator.

-

Retaining Staff

The right pay frequency can also foster loyalty among your workforce, with employees feeling that their needs are truly being considered and met by the company.

-

Motivation and Productivity

For many employees, the anticipation of a paycheck can be a strong motivator. The regular satisfaction of a shorter pay cycle can help to maintain a high morale and productivity. Pay frequency is more than just a technicality; it’s a critical aspect of your organization’s financial strategy and employee relations. A well-considered pay frequency aligns with both the financial needs of your workforce and the operational capacity of your business.

This article does not constitute legal advice. For more information please reference related articles in your APlus HR resource center or ask your friendly APlus CSS about different options to handle specific payroll processes within your Company. Not a client yet? Please schedule a demo here and see how we can help you.