Why Using a Payroll Provider Will Help You Grow Faster Into Other States

by Paul Devlin

I read recently about a company that expanded operations to four new states within a year. The administrative burden of managing payroll in-house was overwhelming. Four new states meant four new sets of laws and four more deadlines. The complexity of adhering to various state tax laws, coupled with the time-consuming nature of payroll processing, can significantly hinder operational efficiency and growth. This is where the strategic value of outsourcing payroll services becomes undeniable, and a partner like APlus Payroll emerges as a critical ally for businesses navigating these waters.

Navigating the Payroll Maze: Common Challenges for Growing Companies

For companies operating in multiple states, the payroll process is far from straightforward. Here are a few common hurdles they face:

-

Time-Consuming Administrative Work: Managing payroll in-house requires a significant investment of time and resources. For large companies with a diverse workforce spread across different states, this burden is amplified.

-

Compliance with Complex Tax Laws: Each state has its own set of tax laws and regulations, which can change frequently. Keeping up with these changes and ensuring compliance is a daunting task.

-

Risk of Costly Penalties and Fines: Errors in payroll processing, such as incorrect tax filings or late payments, can result in hefty penalties and damage a company’s reputation.

These challenges not only strain a company’s resources but also distract from core business activities that drive growth and development.

The APlus Payroll Solution: Streamlining Success

Choosing a reputable company like APlus Payroll to handle your payroll needs offers a comprehensive solution to these challenges. Here’s how APlus Payroll stands out:

-

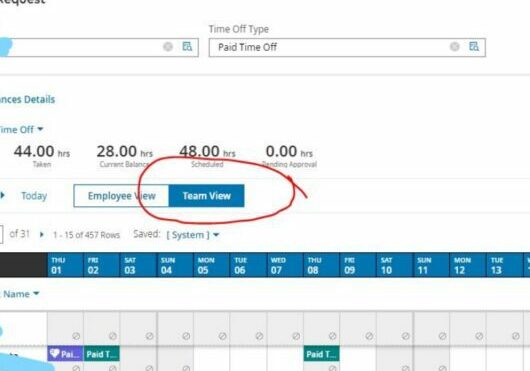

Streamlined Payroll Processes: APlus Payroll leverages advanced technology through UKG Ready to automate and streamline payroll processes, reducing the time and effort required to manage payroll internally.

-

Accurate Compliance: With deep expertise in state-specific tax laws, APlus Payroll ensures accurate compliance, minimizing the risk of penalties and fines. Our team stays abreast of legal changes, providing peace of mind to businesses.

-

Expert Guidance: APlus Payroll doesn’t just process transactions; they offer expert advice and guidance on payroll-related issues, ensuring that businesses make informed decisions.

The Value of a Trusted Partner

Using a trusted partner like APlus Payroll is not just a strategic move—it’s a competitive advantage. It allows companies to navigate the complexities of multi-state operations with confidence, ensuring compliance, minimizing risk, and unlocking potential for growth and development. If you’d like to see how we currently help handle growth for our clients, schedule a demo. No wasting your time. Just simple, common sense advice, tailored to you and your Company.