Can I use Quickbooks with UKG Ready?

by Paul Devlin

A common question we get is “Can I use Quickbooks with your software?” One word. “Yes!” If you are already using Quickbooks, let’s look at the ways APlus Payroll can help you combine these two powerful platforms.

1. The Power of Integration:

When it comes to managing your workforce and financials, UKG Ready and QuickBooks are a dynamic duo. By integrating these two platforms, you can unlock a host of benefits and tap into their combined potential. Here are some key features that make this integration a game-changer:

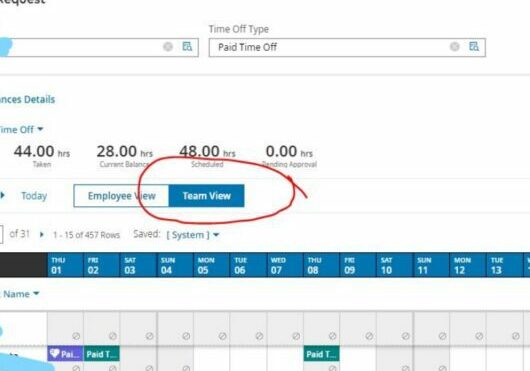

– Seamless Employee Data Sync: The integration allows for the smooth transfer of employee data between UKG Ready and QuickBooks, eliminating the need for double data entry. This ensures accurate payroll processing and eliminates the risk of manual errors.

– Streamlined Payroll Management: With the integration, you can effortlessly sync employee hours, wages, and tax information from UKG Ready to QuickBooks. This saves valuable time and minimizes the chances of payroll discrepancies.

– Accurate Financial Reporting: By linking QuickBooks with UKG Ready, you can automatically generate financial reports that include payroll expenses, taxes, and other related data. This provides a comprehensive view of your business’s financial health without the hassle of manual data entry.

2. Use Cases for This Integration:

The integration between UKG Ready and QuickBooks is ideal for businesses of all sizes. Here are some scenarios where this integration can be particularly beneficial:

– Streamlining Payroll Processes: Whether you have a small team or a large workforce, integrating UKG Ready with QuickBooks ensures a smooth payroll process, freeing up valuable time and resources.

– Enhanced Financial Visibility: Business owners can gain a holistic view of their financials, including labor costs and expenses, by integrating these two platforms. This enables better financial planning, budgeting, and decision-making.

– Compliance and Accuracy: The integration allows for the automatic transfer of employee wage and tax information, reducing the risk of errors and ensuring compliance with tax regulations.

3. Tips for Effective Integration:

To make the most of the UKG Ready and QuickBooks integration, consider the following tips:

– Plan Ahead: Before integrating the two platforms, understand your business requirements and goals. Identify the key data points you want to sync and talk to your customer support specialist to help customize the integration accordingly.

– Work with your Payroll Provider: Companies like APlus Payroll will stair step you through the process, helping make the process as smooth as possible.

– Regularly Update and Monitor: Stay up to date with the latest software versions and releases for Quickbooks. Regularly monitor and reconcile data to catch any discrepancies early on.

Integrating UKG Ready with QuickBooks can significantly streamline your business processes, saving time, reducing errors, and providing valuable insights into your financials. Some parts may require additional Quickbooks modules but there is no reason why empowering your business with this powerful software combination will not make your overall efficiency soar.