Certified Payroll Reporting: Who Needs It and Why?

by Paul Devlin

Certified Payroll Reporting – The phrase itself sounds complicated, but what exactly is it and who needs it? In this post, we’ll explore the importance of certified payroll reporting and how it can be efficiently integrated into your business practices.

Understanding Certified Payroll Reporting

Based on the Fair Labor Standards Act in the United States, employers who work on federally funded construction projects are required to submit weekly certified payroll reports. These reports detail the wages paid to each worker, ensuring they’re being paid prevailing wages and fringe benefits as per the Davis-Bacon and Related Acts (DBRA).

The Benefits of Certified Payroll Reporting

-

Avoiding Legal Penalties: Non-compliance with certified payroll reporting can result in hefty fines, suspension, or even debarment from future contracts. By prioritizing certified payroll, you protect your business from these risks.

-

Fostering Transparency: Certified payroll reports provide a clear record of your employees’ pay and benefits. This transparency can help resolve any disputes over pay and ensure that all workers are paid fairly.

-

Enhancing Reputation: Businesses that prioritize certified payroll reporting demonstrate a commitment to fair labor practices. This can enhance your reputation among clients, potential partners, and future employees.

Streamlining Certified Payroll Reporting

While certified payroll reporting may seem complex, there are ways to streamline the process:

-

Develop a System: Establish a system for collecting and storing payroll data. (APlus can generate the report for you)

-

Train Your Staff: Make sure your HR and payroll staff are well-versed in certified payroll requirements. Your APlus team will help keep you up-to-date with any changes in legislation.

-

Regular Audits: Conduct regular audits of your payroll reports to catch any errors or discrepancies. This can help you stay compliant and avoid penalties.

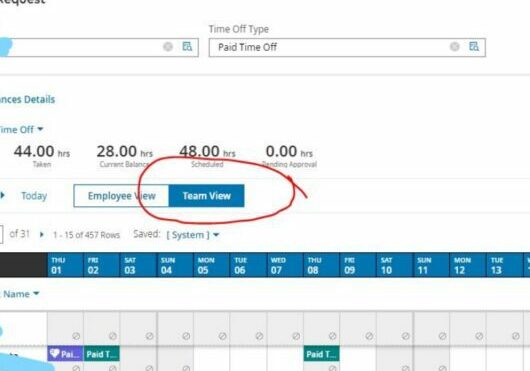

Leveraging APlus for Certified Payroll Reporting

Our UKG Ready software automates much of the reporting process, reducing the risk of errors and freeing up valuable time. Key features may include automatic calculations, digital timesheets, and built-in compliance checks. Certified payroll reporting is more than just a legal requirement – it’s an opportunity to enhance transparency, protect your business from legal penalties, and improve your company’s reputation. Contact your APlus CSS today or schedule a demo here.